HMRC Checks Integration To Bolster the Accuracy of Tax Systems' Cloud-Based VAT Platform | The Fintech Times

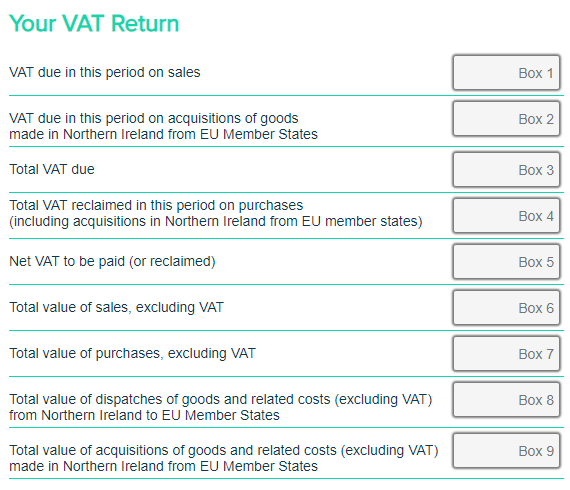

VAT Adjustment: Incorrect Figures Submitted to HMRC: Vat return failed but now won't let me go back to those dates - How-to - QuickFile

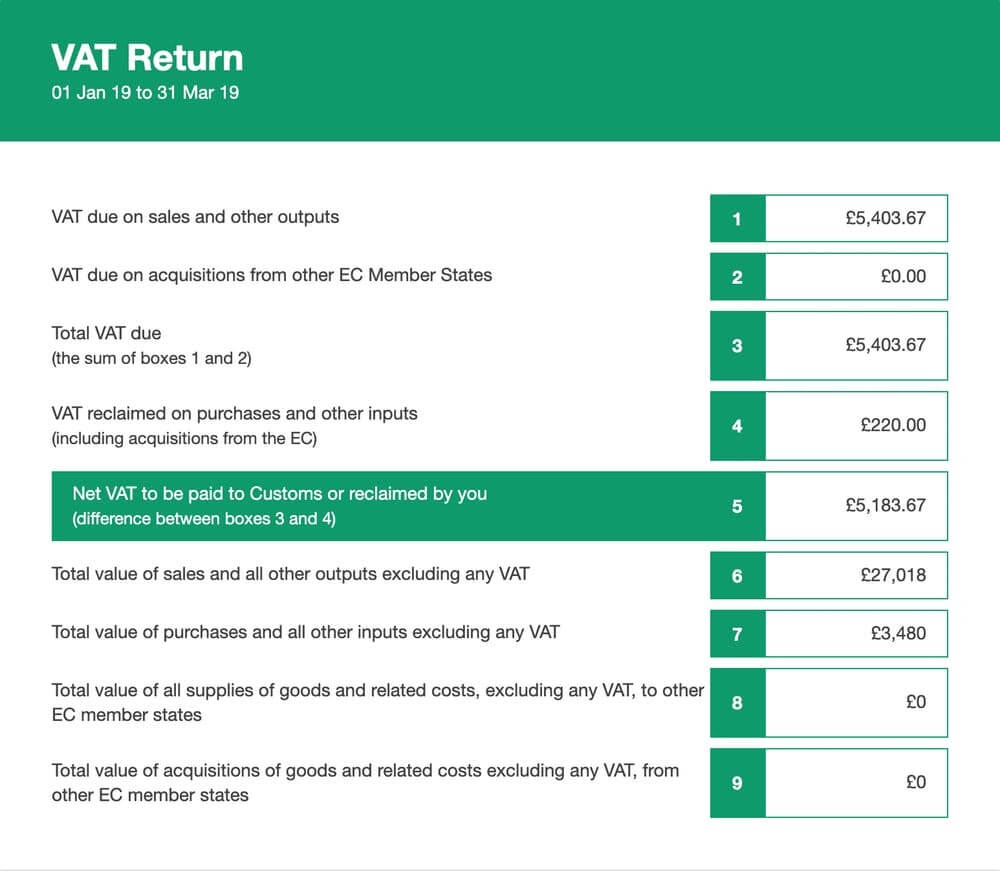

Correcting Errors on Your VAT Return: Guidelines for Adjustments and Required Disclosures | PDF | Value Added Tax | Taxes