Convexity Adjustments Made Easy: An Overview of Convexity Adjustment Methodologies in Interest Rate Markets | BURGESS | Journal of Economics and Financial Analysis

5. Volatility for Rate of Return Guarantees calculated using the BSHW... | Download Scientific Diagram

Convexity Adjustments Made Easy: An Overview of Convexity Adjustment Methodologies in Interest Rate Markets | Semantic Scholar

Convexity Adjustments Made Easy: An Overview of Convexity Adjustment Methodologies in Interest Rate Markets | BURGESS | Journal of Economics and Financial Analysis

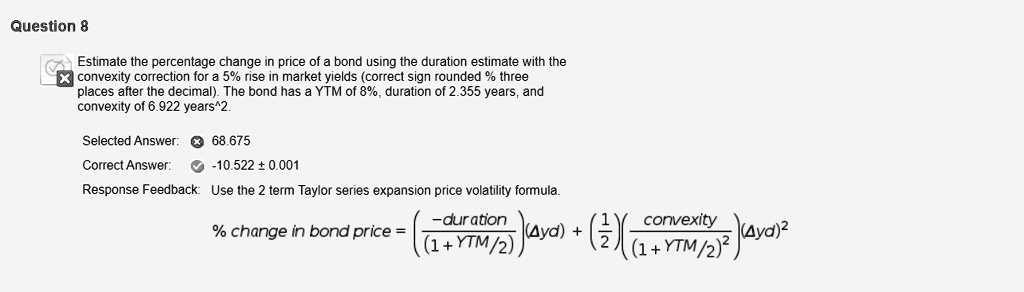

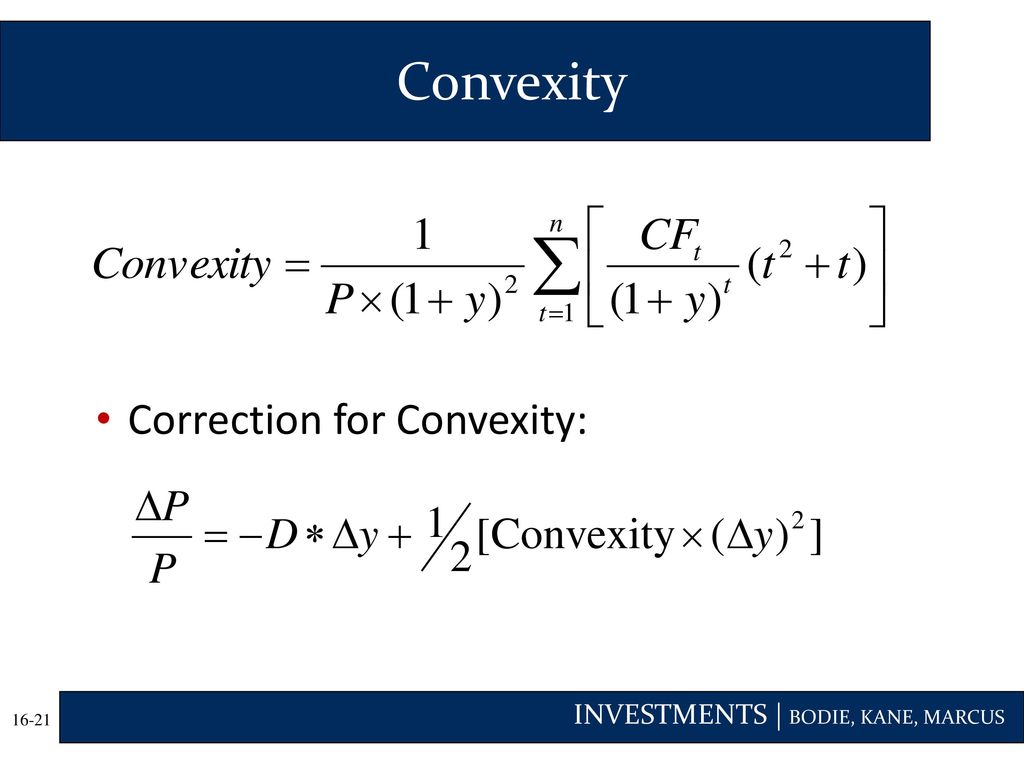

SOLVED: Question 8 Estimate the percentage change in price of a bond using the duration estimate with the convexity correction for a 5% rise in market yields (correct sign rounded % three

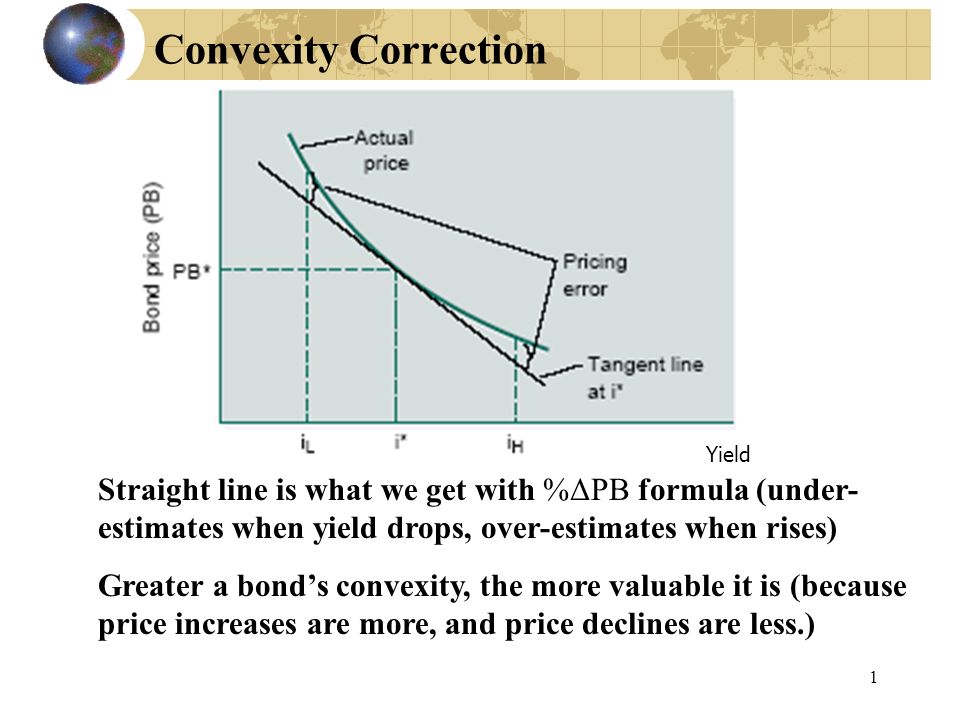

1 Convexity Correction Straight line is what we get with %ΔPB formula (under- estimates when yield drops, over-estimates when rises) Greater a bond's convexity, - ppt download

Convexity Adjustments Made Easy: An Overview of Convexity Adjustment Methodologies in Interest Rate Markets | Semantic Scholar

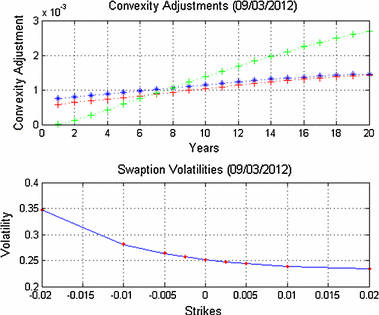

Figure 1 from ANALYTICAL APPROXIMATION TO CONSTANT MATURITY SWAP CONVEXITY CORRECTIONS IN A MULTI-FACTOR SABR MODEL | Semantic Scholar

Mathematics | Free Full-Text | Automatic Convexity Deduction for Efficient Function's Range Bounding

An empirical examination of the convexity bias in the pricing of interest rate swaps - ScienceDirect

Convexity Adjustments Made Easy: An Overview of Convexity Adjustment Methodologies in Interest Rate Markets | BURGESS | Journal of Economics and Financial Analysis

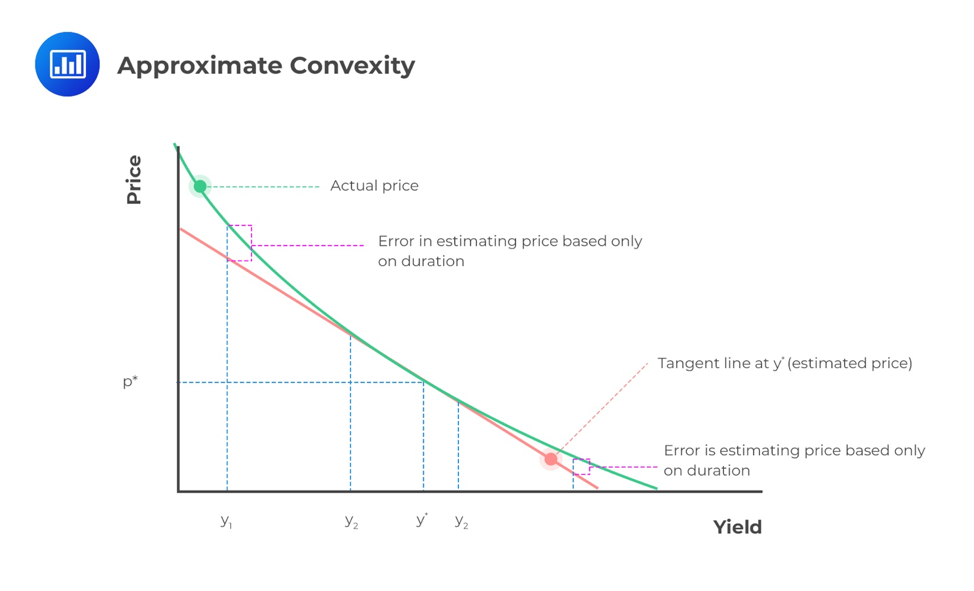

Govind Gurnani on LinkedIn: Knowledge Series : Demystifying A Concept Of Convexity In The Bond Market…

Convexity correction to the par swap rate for a 10 year IDCG futures... | Download Scientific Diagram

:max_bytes(150000):strip_icc()/convexity-4198782-a4e62f51917a4d07a4d03fe386e87c95.jpg)

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)